Life Sciences ESG Reporting Practices

For companies of all industries, ESG matters have become an area of intense focus. In addition to investor and activist pressure, the growth of ESG ratings – and proposed climate and broader ESG disclosure requirements in the US, EU and other jurisdictions – have led many companies to consider beginning or expanding ESG reporting efforts. For life sciences companies, however, ESG reporting is often a particularly perplexing subject. Investor focus on ESG matters is generally a more recent phenomenon for industry companies that also often are unsure which ESG topics are relevant to their business, especially earlier-stage companies. We have prepared this report to help life sciences companies begin to answer such questions and provide insight into industry disclosure practices.

Cooley analyzed 45 environmental, social and governance (ESG) reports from US public biotech and pharmaceuticals issuers published in the past year. The data below is limited to disclosure in stand-alone ESG, sustainability, corporate social responsibility, or similar reports –including dedicated reports under reporting framework templates, such as Sustainability Accounting Standards Board (SASB) or CDP disclosures – and does not include disclosure in Securities and Exchange Commission (SEC) filings. However, in nearly all cases, issuers included significantly more information in such reports than in SEC filings, and it is extremely rare for SEC filings to contain more extensive quantitative or qualitative ESG disclosure.

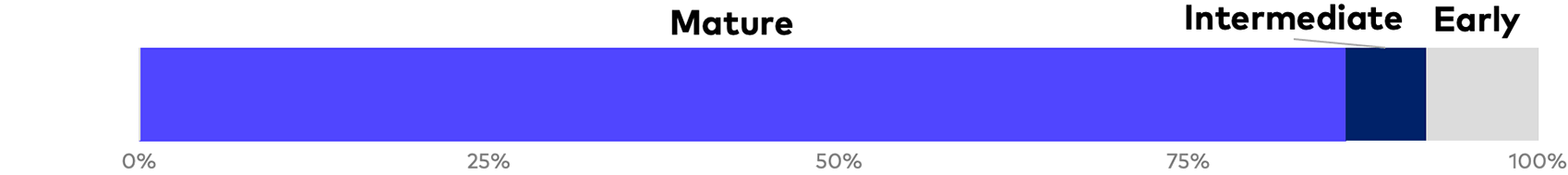

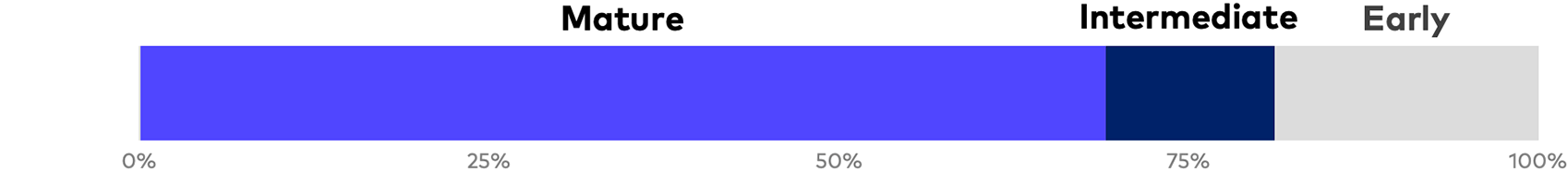

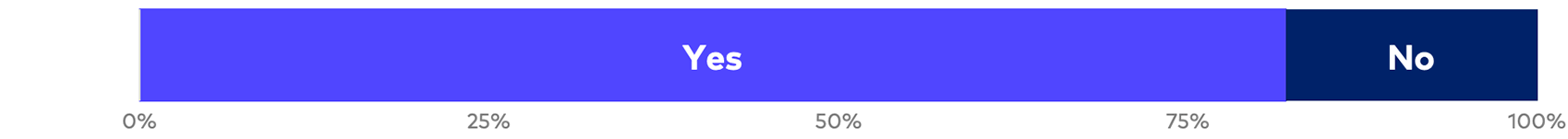

Of the 45 reports analyzed, 44 are from Russell 3000 issuers. As a general matter, the production of stand-alone, voluntary ESG reports is heavily concentrated among large-cap mature life sciences companies with numerous commercialized products and annual revenues of $500 million or more. Nonetheless, our survey includes nine companies that we classify as “early stage,” which includes clinical-stage companies and early commercial-stage companies with two or fewer approved products and revenue of $75 million or less, as well as seven intermediate commercial-stage companies with two or fewer products and revenue between $75 million and $500 million. There has been a significant increase in industry reporting over the past 18 months, and inaugural publications constitute the large majority of intermediate- and early-stage reports. Given general market trends, and with many smaller companies either preparing or planning for ESG reports, we can reasonably expect a continued increase in the volume of reports, levels of quantification and earlier-stage reporting over the coming year.

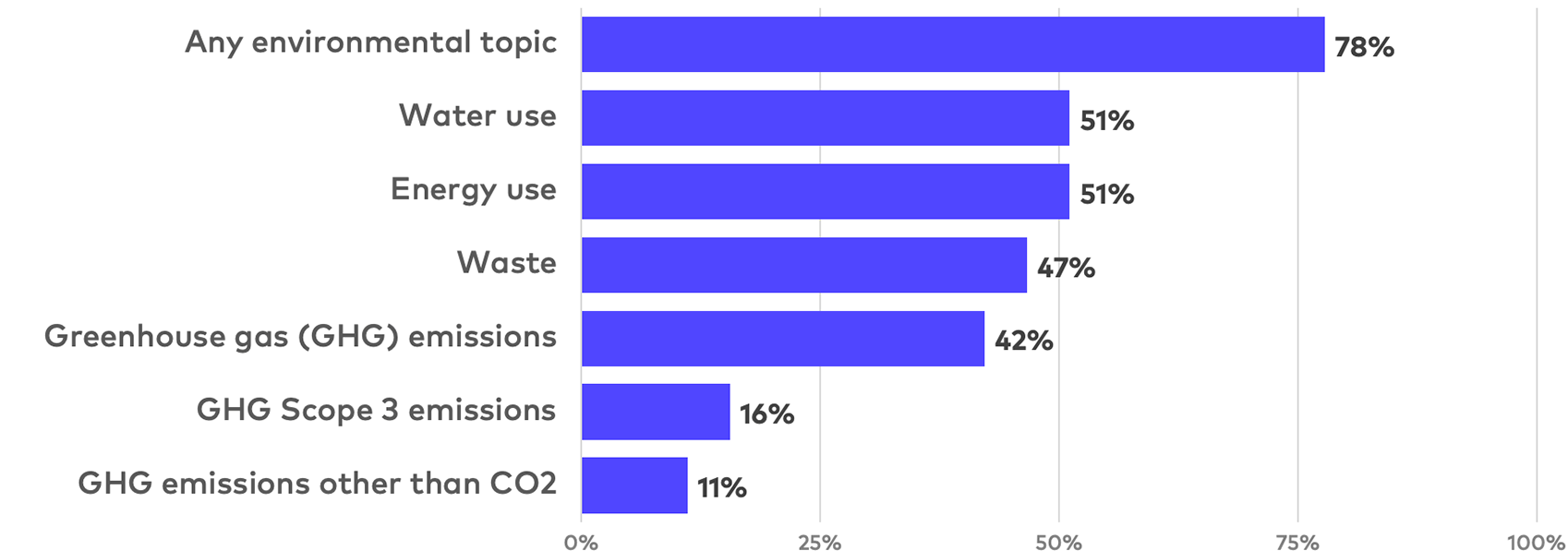

Quantitative environmental disclosure

The table above focuses exclusively on reports that provide quantitative disclosure on environmental metrics – it does not include reports that provide only narrative descriptions of company practices, commitments or philosophies. All mature company reports include at least one quantitative environmental reporting metric, and mature companies represent 86% of all examples of quantitative reporting.

Quantitative environmental reporting examples

Environmental issues are generally less material for life sciences companies, particularly companies that lack significant in-house manufacturing operations or complex supply chains. Nonetheless, partially driven by cross-industry market practice and investor expectations, inclusion of environmental disclosure in ESG reports is common in life sciences reporting. Although less heavily weighted than for other industries, environmental matters generally feature in ESG ratings methodologies applied to life sciences companies. In addition, as the ESG subject perhaps best suited for quantification, environmental disclosure includes some of the most standardized performance metrics, which facilitate company comparability.

Most likely due to the relative ease of tracking, energy and water use are marginally more common topics than greenhouse gas (GHG) emissions, though we may expect this to change as companies expand their emissions-tracking capabilities in anticipation of finalization of the SEC’s climate change rule. Scope 3 (indirect value chain) emissions disclosure remains relatively rare, as such emissions often are considerably more difficult to measure or estimate.

In addition to concerns about potential inaccuracies, for many life sciences companies with outsourced manufacturing operations and significant chemical supply chains, Scope 3 emissions disclosure may present a less positive view of company environmental impacts. In addition, many reports analyzed were published following the release of the SEC’s proposed climate change rule in March 2022, which may have created concerns that publishing Scope 3 data could create future SEC reporting obligations.

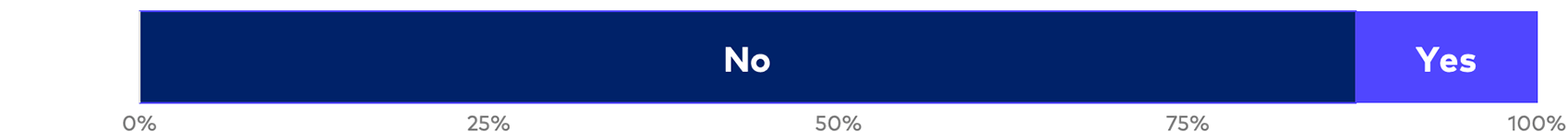

External review of ESG reporting

References to third-party assurance of ESG data remain relatively rare. Disclosure in ESG reports may not capture the full extent of external audits, as companies often engage outside consultants or auditors to provide assurance for internal comfort purposes only.

ESG reporting frameworks referenced

A large majority of reports included references to the role of reporting standards in shaping disclosure, though such standards are implemented with varying degrees of rigor. While many reports do include the now market-standard appendix tables showing framework alignment, such tables often show only partial responsiveness.

Although approximately half of the reports included quantitative disclosure on Scope 1 and 2 GHG emissions, less than a quarter referenced the Task Force on Climate-Related Financial Disclosures (TCFD) framework and provided responsive disclosure on climate governance, risk and strategy. TCFD disclosure is increasingly favored by institutional investors, though it is less relevant for life sciences issuers for whom climate strategy and risk are less central to business. With qualitative TCFD disclosure forming the basis of much of the SEC’s proposed climate rule, however, we expect this to be an area where industry companies increase disclosure. Other frameworks referenced include the SASB, United Nations Sustainable Development Goals (UN SDGs), Global Reporting Initiative (GRI) and United Nations Global Compact (UNGC).

SASB alignment

The SASB standards are the clear industry favorite. Unlike other more broadly applicable frameworks that feature many environmental and social topics less relevant to life sciences companies, the SASB standards are specific to the industry. The SASB biotechnology and pharmaceuticals standards are primarily focused on product development safety and ethics, as well as product safety and availability.

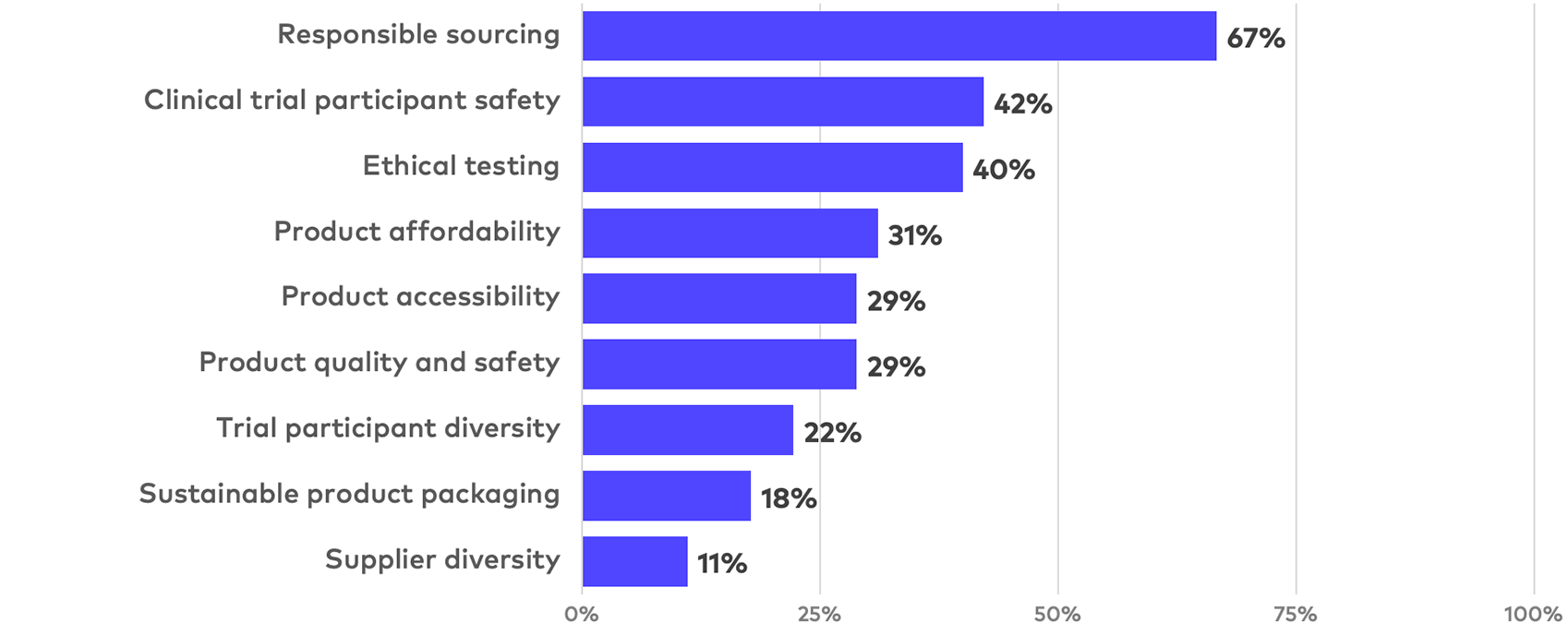

Product and research disclosure

Reflecting the SASB standards and industry ESG ratings methodologies, life sciences reports are heavily focused on product development topics, including supply chain, testing and access to medicines. Nonetheless, disclosure topics vary widely, and there is often incomplete alignment with the SASB industry disclosure topics and accounting metrics.

Highly detailed or quantitative product and research disclosure

In addition to the wide variance in product disclosure topics, there is no clear convergence on topic quantification, with no quantified or otherwise highly detailed topic appearing in more than 30% of reports. Even among mature company reports, the most common quantified topics –product accessibility (i.e., geographic availability) and responsible sourcing (i.e., ethical supplier standards or sustainable supply chains) – only appeared in 34% of reports.

Product social impact disclosure

While detailed or quantitative reporting topics vary widely, it is increasingly common for life sciences reports to focus heavily on the inherent “ESG-positive” quality of their products, with many reports dedicating multiple pages to highlighting the social impact of their approved products and treatment gaps targeted by ongoing research.

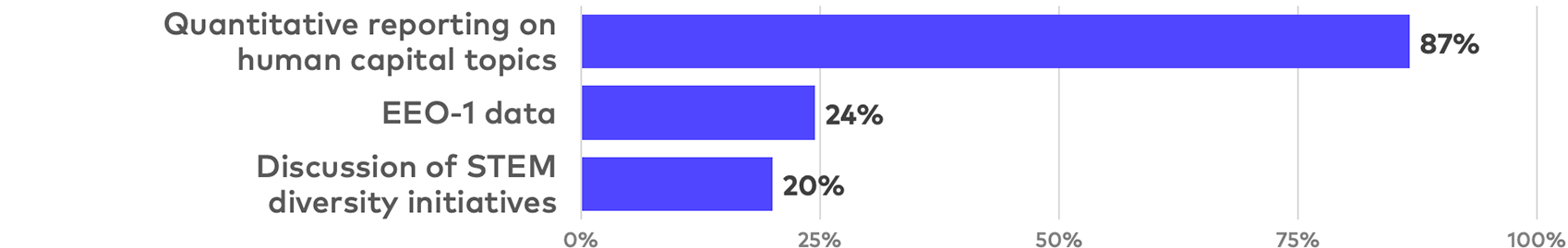

Human capital disclosure

Corporate governance and human capital are more highly weighted for life sciences companies in most ESG ratings due to the limited relevance of environmental, supply chain, labor standards, political controversy and other headline topics. In addition, relatively limited financial expense is required to include governance disclosure and basic employee demographic data in ESG reports, particularly if such information is already included in more limited form in annual proxy statements. As a result, such disclosure is often one of the more cost-effective means of improving ESG ratings.

While quantitative human capital disclosure is a near-universal practice, a much smaller percentage of reports include Equal Opportunity Commission EEO-1 workforce data. Such disclosure in ESG reports or proxy statements is likely to rise in light of increased institutional investor pressure. Although still relatively rare, descriptions of company initiatives specifically focused on diversity in scientific and technical roles is a notable, industry-specific human capital trend.

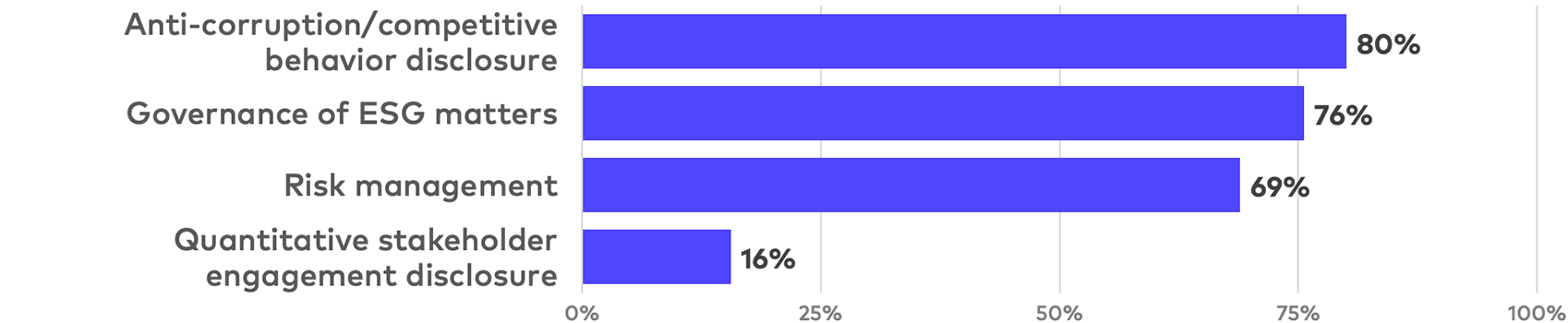

Governance disclosure

Corporate governance disclosure in life sciences reports covers a wide range of topics, with substantive disclosure most frequently covering anti-corruption and competition practices, ESG oversight, and risk management processes. Among the more quantifiable governance topics, detailed stakeholder engagement disclosure remains relatively rare.

Data privacy and cybersecurity disclosure

Due to the sensitivities of trial data and trial participant privacy, data privacy and cybersecurity are heavily weighted topics in industry ESG ratings. Nonetheless, quantitative data privacy disclosure, such as incident figures, is much rarer (seen in only 11% of reports).

With ongoing changes to investor and proxy advisor expectations and policies, ESG ratings methodologies, and regulatory disclosure requirements, we are likely to see sustained growth in life sciences ESG reporting, including increased quantification, reporting standards alignment, and earlier-stage company disclosure. Cooley’s ESG team is continuing to track industry disclosure trends and practices, particularly during the upcoming proxy season. If you have any questions, please contact a member of Cooley’s life sciences or ESG teams.

Related Contacts

This content is provided for general informational purposes only, and your access or use of the content does not create an attorney-client relationship between you or your organization and Cooley LLP, Cooley (UK) LLP, or any other affiliated practice or entity (collectively referred to as "Cooley"). By accessing this content, you agree that the information provided does not constitute legal or other professional advice. This content is not a substitute for obtaining legal advice from a qualified attorney licensed in your jurisdiction, and you should not act or refrain from acting based on this content. This content may be changed without notice. It is not guaranteed to be complete, correct or up to date, and it may not reflect the most current legal developments. Prior results do not guarantee a similar outcome. Do not send any confidential information to Cooley, as we do not have any duty to keep any information you provide to us confidential. When advising companies, our attorney-client relationship is with the company, not with any individual. This content may have been generated with the assistance of artificial intelligence (Al) in accordance with our Al Principles, may be considered Attorney Advertising and is subject to our legal notices.